Medicare recipients with higher incomes face elevated Part B and prescription drug plan premium costs. This scenario, understandably, isn’t well-received – and we share that sentiment! Having interacted with numerous clients in similar circumstances, I’m here to shed light on a potential solution: the IRMAA appeal. This avenue allows you to challenge a heightened Medicare Part B premium. (Please note that this information is up-to-date as of 2023.)

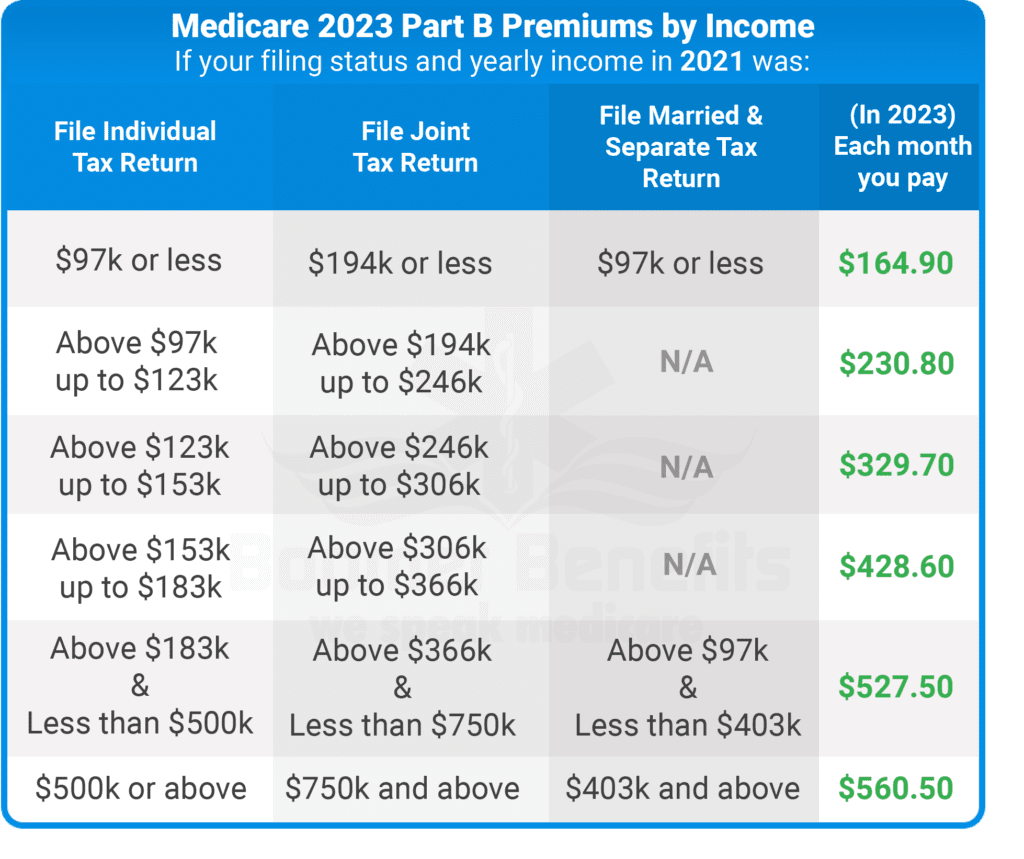

As of 2023, the standard cost of Medicare Part B is $164.90 for individuals who are newly enrolled. This rate is applicable to the majority of beneficiaries. However, those in the uppermost income bracket might find themselves liable for notably higher amounts.

The determination of what you’ll pay is conducted by Social Security based on your modified adjusted gross income (MAGI), which is reported to the IRS. Should you face an increased premium, Social Security labels this additional amount your “income-related monthly adjustment amount” (IRMAA). This sum will be deducted from your Social Security income disbursement. If you’re not currently receiving income benefits, it will be invoiced to you.

The IRMAA appeal is essentially a petition that you can submit to Social Security with the aim of reducing your Part B premium. This entails filling out Form SSA-44 to inform Medicare that you’ve encountered a life-altering event that has impacted your income.

Before delving into the appeal process, let’s delve into the details that factor into the calculation of your premium.

Modified Adjusted Gross Income

Your modified adjusted gross income (MAGI) is comprised of your overall adjusted gross income and any tax-exempt interest earnings. (The Form SSA-44 provides instructions detailing the specific line numbers on your IRS Tax return to use for this calculation.)

Examples of income that you might have disclosed on your tax return encompass wages, dividends, received alimony, rental income, farm income, investment gains, capital gains, and Social Security benefits. Deductions that you may have claimed on your tax return could include items like student loan interest, alimony paid, tuition expenses, and contributions to retirement plans.

Social Security bases its calculations on the income details you provided in your most recently submitted federal tax return. Consequently, they often determine your premium using the MAGI reported from two years prior to the present time. In other words, your Medicare premiums for 2023 will typically hinge on the MAGI from your 2021 tax return, and this pattern continues for subsequent years.

If they determine you owe a higher premium based on your MAGI, they will send you a letter to notify you of your new amount. They will also give you the reason for their determination. If you disagree with this amount, you have the right to appeal it via a reconsideration request.

Qualifying Reasons for a Medicare Part B Premium Appeal

There are various grounds on which you may become eligible for a reduced premium. Social Security designates these instances as “Life-Changing Events.”

Among the most frequent scenarios is the transition from active employment to retirement or a decrease in working hours. During this shift, your monthly income typically experiences a notable decline compared to your working years. For instance, consider a scenario where you are an individual and your earnings were $96,000 at the time of your retirement in 2021. Subsequently, your post-retirement income consists of solely $40,000 from Social Security and IRA distributions. This situation lends weight to your argument against being subjected to a heightened Part B premium based on your former income.

Other reasons for an IRMAA appeal may include:

- Changes in marital status such as marriage, divorce, or becoming widowed

- Loss of income-generating assets

- Modifications or discontinuation of a pension plan

- Reception of a settlement from an employer due to company closure or bankruptcy

At times, individuals may also dispute the accuracy of the MAGI information reported by the IRS to Social Security. In such instances, it is necessary to communicate with the IRS and rectify the data prior to initiating an appeal. Filing an amended tax return could potentially rectify the issue.

Our team has received feedback from numerous clients concerning appeals, revealing a range of outcomes. For instance, in situations where a year included capital gains or the sale of property that raised annual income, the results of appeals have been mixed. Approvals may be influenced by the magnitude of the gain. On some occasions, your premium might be adjusted, while in others, it could be argued that your tax return indicates substantial earnings, justifying a higher Medicare Part B premium for the year.

If there’s one piece of advice I could offer, it would be this: There’s no harm in attempting an appeal, especially if you can provide evidence of an income change. The appeal process incurs no cost, and by presenting your case effectively, you may potentially save on expenses. For insights into how to initiate an appeal and what documents to submit, you can also refer to our YouTube video on IRMAA appeals.

How to file your Medicare Reconsideration Request

If you intend to challenge your IRMAA, you should obtain and print Form SSA-44 titled “Medicare Income-Related Monthly Adjustment Amount-Life-Changing Event.” This form provides step-by-step guidance for updating your income details and outlines the necessary documentation to validate your revised MAGI.

Similar to any appeal, the crux lies in your documentation. Draft a cover letter elucidating the reasons for your belief that you’re being charged excessively. Subsequently, present corroborative documentation. For instance, you could enclose a letter from your former employer confirming your retirement, coupled with a copy of your last pay stub illustrating your previous earnings that are no longer applicable.

Additional documents that could support a case of income loss encompass bank statements, termination or retirement letters from employers, and other financial records.

In essence, furnish as many authorized documents and factual details as possible to bolster your argument.

Upon a successful appeal, Social Security will automatically correct your Medicare Part B premium rates. In the event of an appeal denial, you’ll receive instructions on how to escalate the appeal to an Administrative Law Judge.

Keep in mind that while your appeal is being processed, you will continue paying the elevated Medicare Part B premium. Nonetheless, if your appeal is granted, it might apply retroactively to months for which you’ve already made payments. If this applies to your case, a refund won’t be issued, but the overpaid premiums will be credited toward your upcoming Part B premiums.

Part D Income Adjustments

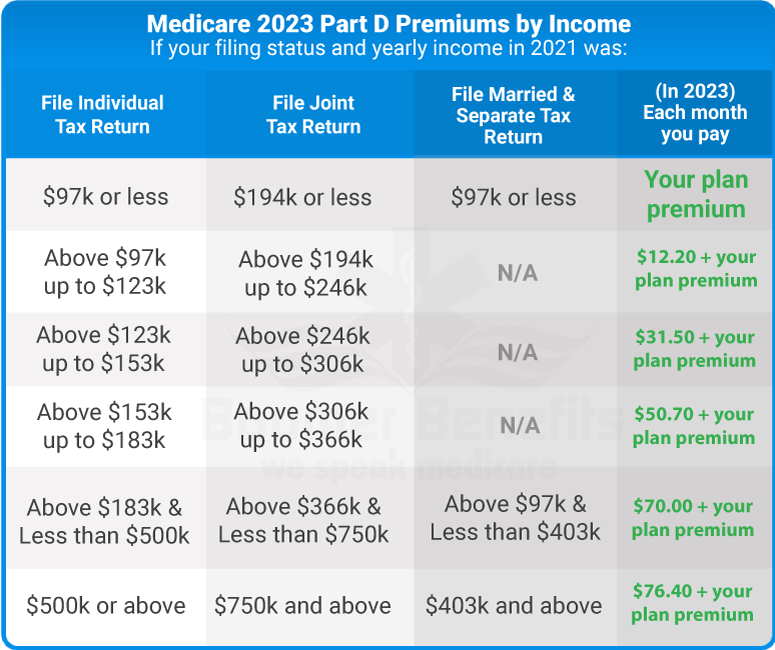

IRMAA also affects your Part D premium. Unlike Medicare Part B, your Part D premium varies based on which Part D drug plan you have chosen to enroll in. Right now, in 2023, Part D premiums range from around $7 to over $180/month, depending on where you live. (For more on finding the right Part D plan, visit our pages about Part D.)

It is important to note, the extra amount you pay will not be part of your plan premium. Most people have the extra amount taken out of their Social Security check. Should you choose not to have it taken out of your check, you will receive a bill from Medicare directly. In order to keep your Part D coverage, you must pay the extra amount in full.

Let’s say you enroll in a plan that has a $30/monthly premium. If Social Security has advised you that you owe an income adjustment for higher income, you will pay an “adjustment” on top of your $30 monthly premium.

Plan the timing of your Medicare enrollment

Social Security handles the adjustment of your premium annually, coinciding with the commencement of each new year. Typically, in December or January, you will receive a letter detailing your upcoming premium for the impending year. Consequently, if your income has declined, Social Security will eventually catch up and automatically decrease or eliminate your IRMAA. This serves as a glimmer of hope on the horizon!

For those aware in advance that they will face higher premiums, strategic retirement planning becomes crucial. Collaborate with your financial advisor to determine the optimal timing for initiating distributions from retirement accounts, aiming to minimize the impact on your Medicare premiums.

Initiating an appeal to reconsider your Medicare Part B premium constitutes the primary step. Once you’ve addressed your Medicare costs and are prepared to explore Medicare supplement options, additional opportunities for savings arise. It’s truly astounding how numerous individuals with higher incomes remain unaware of these plans. Agents who neglect to discuss these money-saving alternatives with their clients are doing them a disservice.

The suitability of these plans for individuals with higher earnings becomes evident due to their financial reserves. This offers the flexibility to consider Medigap plans that involve a degree of cost-sharing in exchange for significantly reduced monthly expenses. While there might be instances where you incur costs like deductibles or coinsurance during years marked by medical expenditures due to health issues, the cumulative savings over the years can be substantial.

Plans that Save You Money

Plan G stands out as a particularly favored option among our clients with higher incomes. In exchange for covering a modest annual Part B deductible ($226 in 2023), it’s feasible to encounter premiums that are up to $250 lower compared to those of a Plan F. This translates to retaining more funds in your own pocket.

Beyond Plan G, Medigap Plans L, M, N, and High Deductible F also emerge as excellent solutions for individuals with higher incomes. Curiously, these plans aren’t frequently discussed by agents, yet they offer substantial savings while entailing slightly elevated cost-sharing. The noteworthy aspect is that Medicare continues to cover 80% of your outpatient expenses. By opting for a plan featuring a slightly higher deductible or increased coinsurance, you can seize the opportunity for considerable savings. Moreover, selecting a plan with lower premiums can help counterbalance any heightened Medicare Part B premiums you might be subject to.

Key Takeaways

- Social Security evaluates your income from 2 years prior to determine what you will pay for Medicare Parts B and D in the current year.

- The income brackets and premiums change every year.

- You can appeal IRMAA if you have a qualifying event.